A Small Business Administration official told Billings business leaders Tuesday that the state's banks are setting the pace across the region in processing applications for the agency's new Paycheck Protection Program (PPP).

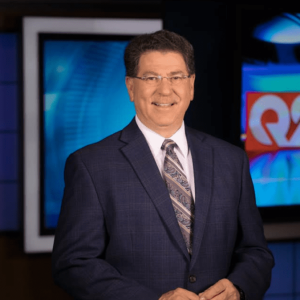

Brent Donnelly, director of the agency's Montana division said thousands of applications have been process by Montana banks since the PPP program launched last Friday at a tele-conference hosted by the Billings Chamber of Commerce.

While Donnelly could not provide specific numbers, he said during the program's first 24 hours, Montana banks processed thousands of applications, more than any other state in our region.

Funded through the new federal COVID-19 relief bill, the CARES ACT, the $350 billion PPP program offers small businesses and non-profits up to eight weeks of payroll costs, with a forgiveness component.

Donnelly described PPP as an employee retention program, designed to help businesses navigate the next couple of months and help keep their top employees on the payroll.

Another SBA program, Economic Injury Disaster Loans (EIDL), is now handling more than three million applications from across the country.

Donnelly acknowledged the number of EIDL applications had overwhelmed the SBA website, but he said technicians working over the weekend have improved its capacity.

Under the EIDL program, businesses can get up to a $2 million dollar SBA loan. The program also features a $10,000 advance option to provide business owners a quick infusion of cash while they wait for their loan to be approved.

Steve Arveschoug, executive director with Big Sky Economic Development, said in the past week, 50 local businesses from Yellowstone County had applied for BSEDA's new Business Stabilization Loans.

Arveschoug said the average loan under that program is around $10,000, with a maximum of $15,000. That program, he said, is to help local businesses "bridge the gap" while they wait for the SBA funds to hit the street.

Regarding that, Donnelly did confirm that his office is already approving loans, and that funds are being dispersed.